TLDR: Banks play a crucial role in our economic system by utilizing the money multiplier effect to create credit and foster economic growth. Lending out part of the deposited money, only to get it back as a deposit, which can again be lent out, is how it happens. And this is why if all the depositors ask for their money back, the bank won’t be able to return them their money. To prevent such a situation, central banks keep an eye on the banks. But sometimes, they miss the signs of an impending doom, or worse, are too late to act on those signs.

You may have heard of banks like JPMorgan, Wells Fargo, or Bank of America, but have you ever wondered how they can create so much money out of thin air? It's all thanks to the powerful tool known as the money multiplier effect. Banks use this financial wizardry to turn small reserves into a tidal wave of loans and economic activity. In this article, we'll explore how banks use the money multiplier effect to make money work for them, and why it matters for the rest of us. While the money multiplier effect can be a powerful tool for banks to create economic growth, it could pose a risk of potential harm if not managed properly. One of the main risks is the possibility of financial mismanagement by banks, which happened in the 2008 financial crisis. Anyway, you’re here now - Lehman Brothers isn’t. Without further ado, let's deep dive into how banks make money using your money.

How do banks work?

As kids, we used to think of bankers as people who store our savings in secure vaults, and return it back to us when we need it. In reality, banks do something magical when we deposit our savings in them. The money multiplier effect lies at the heart of our economy, enabling entrepreneurs, small businesses, and many others by creating credit.

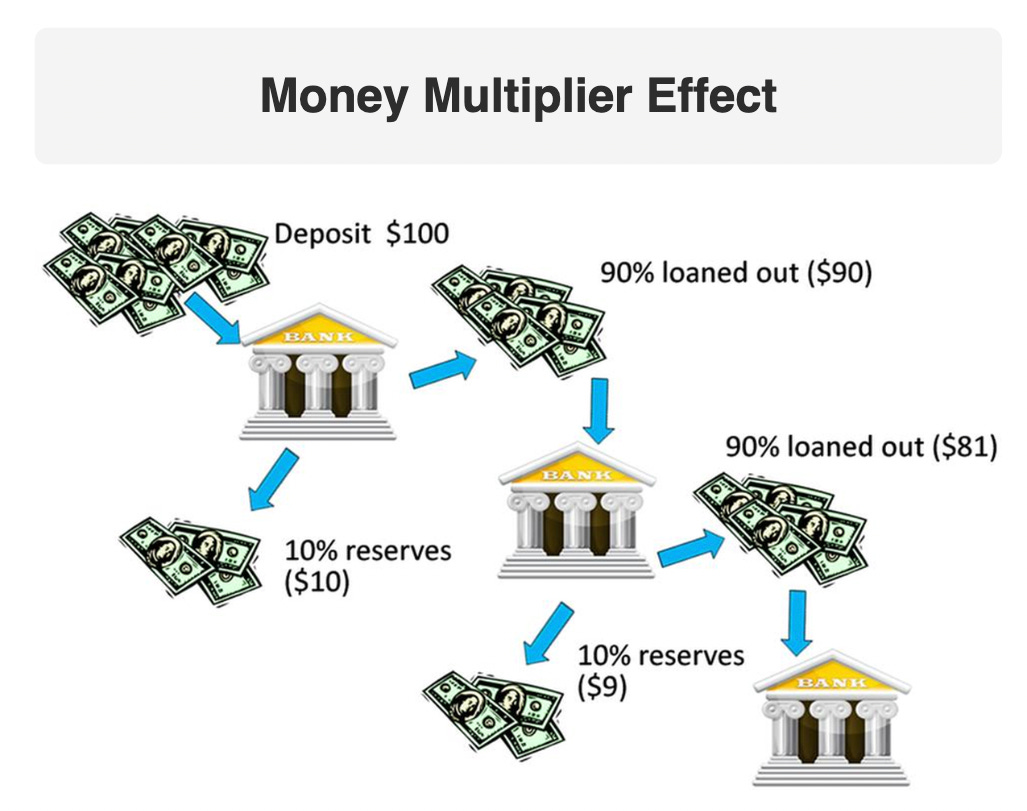

Let’s try to understand the money multiplier effect using a simple example:

Let’s say that I have saved money worth Rs. 100. I decide to invest this money into a savings account with a bank. The interesting fact to note here is that the bank is obligated to hold only a fraction of the deposit with them and is free to use the remainder of my savings for investing, lending, and so on. Let’s say that this fraction is 10% for all deposits. Now, this means that the bank is obligated to keep only Rs. 10 with them at all times and is free to use Rs. 90 for lending, and investing in stocks, bonds, and other financial instruments. For simplicity, the bank decides to lend this Rs. 90 to a bakery store and charges interest on the loan. To incentivize depositors into keeping their money in the bank, a portion of the interest earned by the bank is paid to the depositors also. Coming back to the bakery store owner, they decide to buy an oven from an oven manufacturer for Rs. 90 to meet their customers’ demands (the amounts used in this example are purely arbitrary and for explanatory purposes. They do not represent actual values). The oven manufacturer decides to deposit the Rs. 90 that they earned into a savings account with another bank. The second bank lends out this money to another borrower and charges interest on the loan, repeating the process.

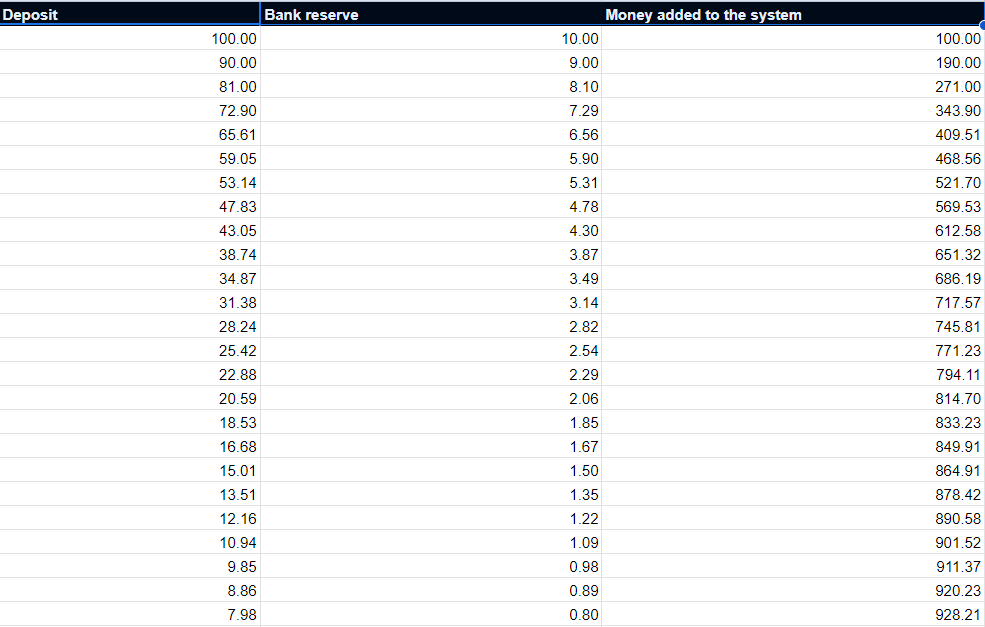

This cycle is repeated countless times, creating more credit in the system that can be used by entrepreneurs, business owners, and others to actually produce goods and services that run the economy, growing the real GDP of the world. Still confused? Check out the Excel sheet below.

…so on

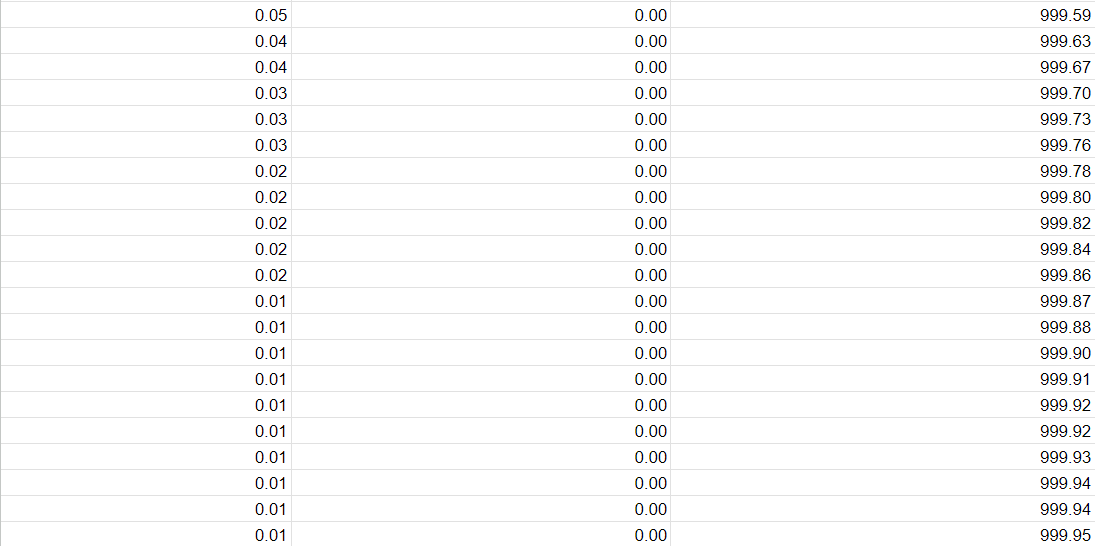

An interesting observation from the example discussed above is that due to repeated lending by banks, approximately Rs. 1000 was added to the economy. Essentially, the Rs. 100 that was lent initially was magically multiplied into Rs. 1000! This effect has been termed the money multiplier effect by macroeconomists.

Enter the money multiplier effect

The example we looked at above was restricted just to lending, here’s what the money multiplier effect looks like in reality:

The central bank injects money into the economy by purchasing government securities or by lending money to commercial banks. Commercial banks use this money to lend loans to businesses and individuals or invest in treasury bonds, stocks, etc. The businesses and individuals who receive loans from commercial banks use them to purchase goods and services or invest in financial instruments. The recipients of these purchases and investments may deposit their money into banks, which are required to only keep a fraction of the deposit as reserves. The remaining deposits can be used by banks to lend even more money, increasing the money supply in the economy. This system is embedded at the heart of the global financial system. It transforms money into actual goods and services.

This process of lending, spending, and re-depositing continues, and each time it does, the amount of money in circulation increases. This is why the effect is termed the “money multiplier effect”. However, it is important to note that the actual size of the money multiplier effect is influenced by various factors, such as the reserve requirement set by the central bank, the willingness of commercial banks to lend, and the demand for credit from businesses and individuals.

Why banks are the most important institutions today

The economic system relies on the trust and confidence of customers in their banks; if too many people panic at the same time and withdraw their money, it leads to a “bank run”, resulting in the collapse of the bank. Today, however, a single bank collapse can endanger the entire global economy, owing to globalization. This is precisely what happened during the financial crisis of 2008 and the recent collapses of Silicon Valley Bank, Signature Bank, and Silvergate Bank. To ensure that such a situation does not arise, the US government insures depositors up to 250,000 USD on their deposits. The Federal Reserve monitors the activities of commercial banks through various monetary policy instruments like the reserve ratio (the fraction of deposits that banks must keep with them at all times), interest rate policy, and so on. The central bank controls the rate of inflation and economic growth by controlling the money supply, making them the most important and powerful institutions in the world. Bad policy and mismanagement by central banks and commercial banks, can spiral into recessions and impact all of us.

Central banks have a vital role to play in monitoring the activities of commercial banks and ensuring the stability of the financial system. However, this power also comes with potential risks such as financial mismanagement, which can lead to economic crises as seen in the 2008 financial crisis. The money multiplier effect remains a powerful tool for banks, but it must be managed responsibly to prevent the negative consequences that can arise from financial mismanagement.

Over the next few articles, we will be taking a deep dive into the domino like fall of banks over the past few months. So stay tuned.